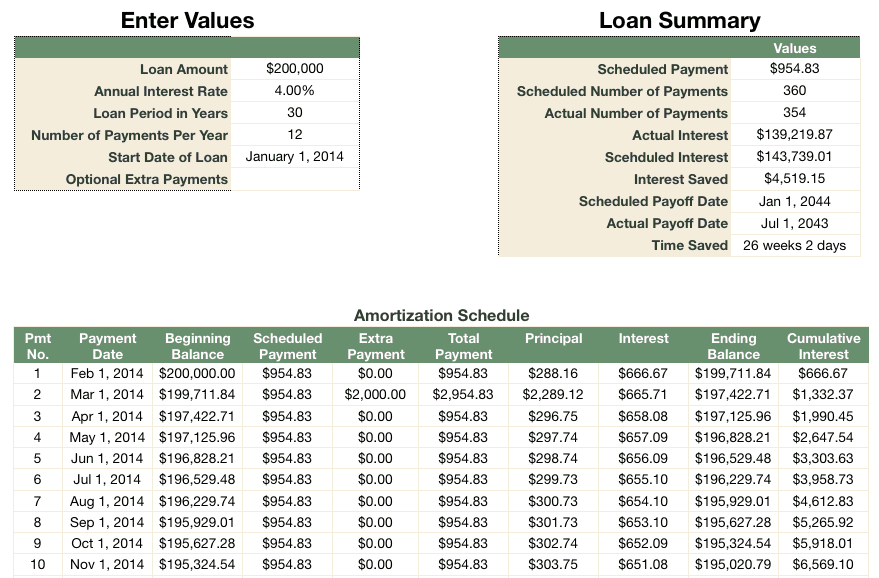

Let’s say you have a 25-year, $400,000 home loan at a 3.50% interest rate. Specify how far into the loan schedule you’ll make these extra repayments.Enter how much your extra lump sum payment will be, or how much extra you’ll be paying per month.Enter the loan amount and the loan term (the length of the loan).Our home loan extra repayment & lump sum payment calculator can show you just how much difference extra repayments can make to your overall loan.Īll you have to do with our extra repayment/lump sum calculator is: Interest is charged on this principle amount, so the smaller the principal, the less there is to charge interest on.Īlso the more you repay, the quicker you’ll pay off the loan. The longer you have the loan for, the more you’ll have to pay.īut what if there was a way to reduce the length of your home loan, and save on interest? By making an extra lump sum payment off your loan, you can.Īny extra repayment you make - be it lump sum repayments or recurring repayments above the minimum - can save you money simply because it reduces the principal on the loan, aka the borrowed amount left to repay. The average home loan can last 25-30 years, which is a long time to pay something off. While the home itself will cost several hundred thousand dollars at least, the interest component of that loan could easily add another couple of hundred thousand dollars. Mortgage Recasting Vs.A home loan is likely to be the biggest expense you will ever have.

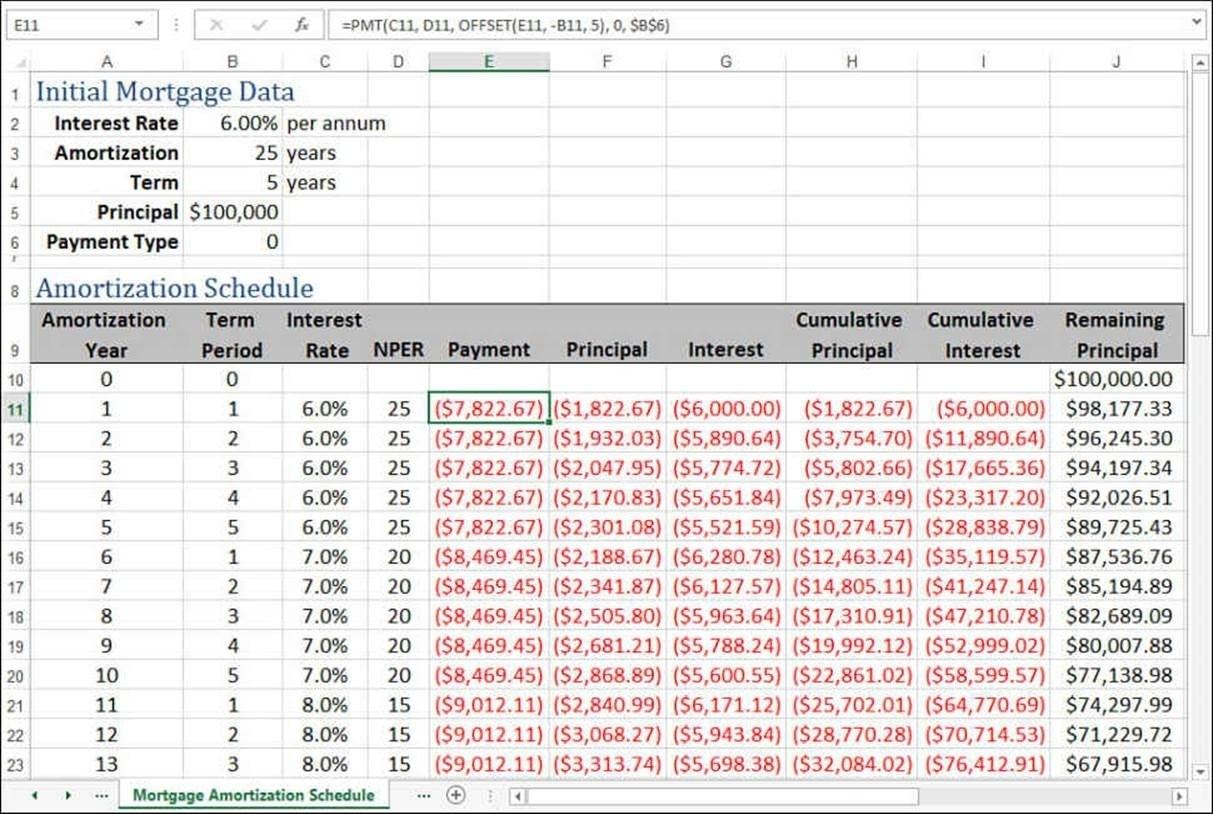

Following is a table that shows the differences between recast and refinances.

Recast and refinance can both save you money on interest payments, and may reduce your monthly payments, but they work differently. On the other hand, refinancing could get you a reduced interest rate, and you can even change your terms. Some lenders do not allow recasting - borrowers should check with their bank to see if they allow recasting before taking any action.Ī mortgage recast is different from refinancing because recasting does not initiate a new loan whereas refinancing involves applying and getting approved just like the mortgage process.Ī mortgage recast does not affect the interest rate and terms, the only thing that changes is the reduced monthly payments.If the borrower doesn't have a large amount saved up, it may not be worth the effort after the upfront costs. Minimum payment - many lenders require a minimum lump sum payment for recasting.The mortgage term remains the same - the borrower will not be able to pay off his mortgage any time earlier.If the interest rate is declining, refinancing may save the borrower more money than recasting. The interest rate doesn't change - the interest rate remains the same for the mortgage.While there are many good reasons for recasting, there are also downsides. Borrowers pay only a few hundred for recast. Low upfront costs - the upfront costs are cheap compared to refinancing.No credit or income check - since recasting does not initiate a new loan as refinancing does, there is no credit or income check.Lower monthly payments - after the mortgage is re-amortized, the monthly payments will be lower from now on.Save money on interest - depending on the size of the lump sum payment and the mortgage size, the borrower could save thousands and thousands of dollars on interest payments throughout the loan.Following are the mortgage recast pros and cons. There are advantages and disadvantages of recasting a mortgage depending on the borrower's situation. The fees should be well worth it if the lump sum is large because a reduced balance could save a borrower thousands in interest payments. Borrowers should talk to their lender and ask for the exact amount they have to pay for recasting. There are also processing fees to recast a mortgage which could cost a few hundred dollars. Lenders usually have a minimum requirement for this payment, it can be anywhere from $5,000 to $10,000. To recast a mortgage, borrowers need to make a one-time lump sum payment. Since interest payment is recalculated every month based on the remaining balance, the lower monthly payment means the borrower would save a lot of money on interest payments throughout the loan. The interest rate and the terms remain the same for the mortgage, but the monthly payments are reduced due to mortgage recasting. A mortgage recast is when a borrower makes a large payment to reduce the principal of the mortgage, and the lender re-amortizes the loan based on the new balance.

0 kommentar(er)

0 kommentar(er)